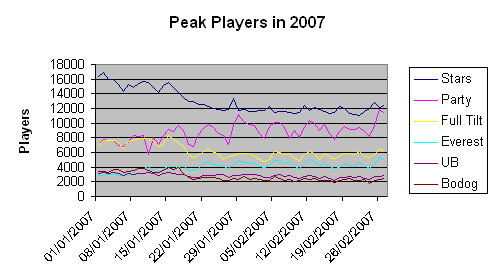

I’ve been tracking the numbers of the online poker rooms ever since Neteller bolted on the US. Below is a graph of the peak cash game player numbers from Jan 1 – Pres. Of interesting note is that all US facing poker rooms have a negative slope.

Source PokerSiteScout

Stars seems to be bumping around the 12,000 player mark and FTP is having trouble gaining any traction above the 6000 player level.

I did some analysis of the market size of the online poker industry in terms of these 6 players. Obviously the market is larger than these six so my analysis may be flawed but it shows a 20.62% increase in market size from Sept 1, 2006 – Feb 28, 2007.

However from Sept 1 – Feb 28 Stars has increased 40.03%, Party is down 8.41%, Tilt is up 67.99%, Everest is up 157.59%, UB up 15.82%, and Bodog is up 52.84%. With the exception of Party, who walked away from 70% of their player base, all rooms show an increase from Sept 1 numbers.

Unfortunately, the numbers don’t look so good when you look at the graph above. Though Party’s players migrated to other US facing sites post Oct 13 those sites are obviously having difficulties holding onto the players. At the beginning of 2007 Stars was averaging about 16,000 cash game players at peak and two months later they’re having a hard time cracking 12,000.

Since Jan 1, 2007 Stars is off 24%, Tilt down 11%, UB down 23% and Bodog down 30%. Meanwhile Everest (non-US) and Party are up 70 – 75% each.

While it’s impossible to draw accurate conclusions without much better data points it does seem that once the rush of players left behind by Party were absorbed that the US market has been shrinking. If you were to take the peak numbers for Party, Stars, Tilt, UB and Bodog on Sept 1 the number of players was 29358. Now if you look at the Feb 28 numbers for all of the previously mentioned but exclude Party there are only 23332. I know that’s not an accurate way to look at it but to get a more accurate picture you have to somehow eliminate Party’s post Oct 13th non-US growth.