Now that we’re several months into the new year I wanted to take a moment to discuss the current state of affairs in online poker.

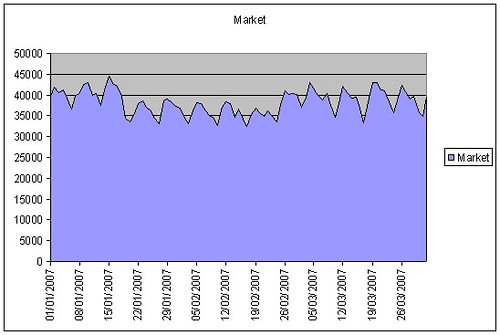

Neteller’s Jan pullout from the US market had a pretty negative impact on the overall industry. Of six big name card rooms, peak players dropped from about 42,000 a day to about 37,000 a day. That trend was pretty solid through the remainder of Jan and all throughout Feb. Things have recovered overall but we’re still running just a tad under the numbers we were doing on Jan 1.

On the surface that looks somewhat promising. Though I will repeat what I’ve said since the beginning which is we still haven’t even seen the full brunt of the law yet. Almost everything we’ve seen so far has been voluntary. Sites like Party left voluntarily. In the strictest sense Neteller also left voluntarily. When this law is actually turned into rules that banking institutions have to follow many of the payment methods Americans are using to get around everything will dry up. While I still think that there will be ways around the banking rules for those tenacious enough, it’s my opinion that the law will be just effective enough to continue to keep growth either slightly negative or overall neutral for the foreseeable future.

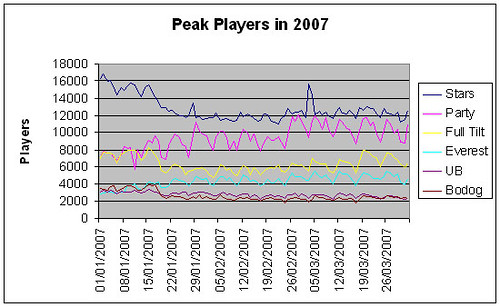

Also to keep in mind is that Party and Everest are two of the six companies in this analysis (the other being Stars, Full Tilt, UB and Bodog) and neither of them accepts US customers. When you take Everest and Party out of the analysis the market has actually shrunk pretty substantially. The market starts from Jan 1 at around 30,000 peak players and today we’re a tad shy of 25,000.

In fact, I may completely redo the list of sites I follow because the market shift has so radically impacted site rankings. For instance, today five of the top ten rooms, in regards to peak players, don’t accept US customers. Bodog and Ultimate Bet who used to be major players in the online poker space are hanging on to spots nine and ten respectively.

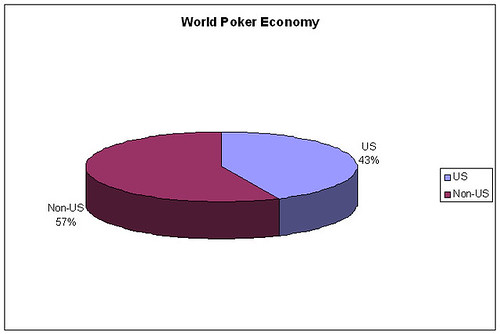

Contrary to what has been true for most of the growth of this industry, the US market no longer holds the advantage. Numbers gathered from all the rooms covered by PokerSiteScout indicates that 57% of all peak player numbers come from sites that don’t accept US players. True, no single market is as big as the US but you have to keep in mind that poker is still in its infancy in many of these non-US markets and there’s room for substantial growth.